16 Oct Best Lowest Deposit Casinos to have 2025 $1, $5 & $ten Choices

The ability to withdraw the profits is really what distinguishes no-deposit incentives from playing games in the trial mode. All the incentives available at $step one casinos come with fine print. These could tend to be betting conditions, whereby you must choice your own winnings a lot of moments one which just cash out, and you may a maximum win or detachment https://vogueplay.com/au/mfortune-casino-review/ restriction. You can observe the brand new constraints on the any $1 bonus that you could claim by the examining the fresh T&Cs in advance. To put it differently, you might deposit just just one dollars from the $1 gambling enterprises to claim bonuses and you may gamble a popular slots and games. The best thing about $step one deposit gambling enterprises is because they enables you to try a casino and you can everything it should give at the little prices.

When you are claiming the brand new ODC although not the new CTC, you can’t allege the brand new ACTC.. She or he turned into 17 to your December 30, 2024, which is a resident of your All of us and advertised because the a depending in your get back. You cannot utilize the kid to claim the fresh CTC otherwise ACTC because the son wasn’t less than many years 17 in the bottom away from 2024. The maximum amount of ACTC for each being qualified man risen to $step 1,700. If the borrowing from the bank for 12 months just after 1996 is quicker or disallowed from the Internal revenue service, you can even need to document Mode 8862 together with your come back. If you take which credit, complete Setting 8962, Superior Tax Credit (PTC), and install it for the come back.

Solution Lowest Tax (AMT)

It inhibits delays within the processing the come back and you may providing people refunds. For individuals who discover a questionnaire having incorrect information regarding it, you need to inquire the new payer to own a reversed setting. Label the telephone number or produce to the address provided to own the new payer on the mode. The newest remedied Mode W-2G otherwise Setting 1099 you get are certain to get an enthusiastic “X” regarding the “CORRECTED” field on top of the design. A different function, Setting W-2c, Remedied Wage and you can Income tax Statement, is used to fix a type W-2. For individuals who request the design, your employer need to send they to you in this 1 month after finding their authored consult otherwise inside 1 month once one last salary fee, any is actually later on.

Florida legal wagering timeline

It might be very easy to just number the banks providing the better sign-upwards bonuses and leave it at this. The fresh Wells Fargo Everyday Savings account is a wonderful bank account choice for somebody as it pays an extremely ample bonus you to definitely’s easy to qualify for. Radius Bank Benefits Checking is best for people that like the constant perks attained away from endless step one% cash return for the debit cards sales.

Try a six contour paycheck an excellent?

- You might be entitled to a young child tax borrowing for every qualifying son who was simply under many years 17 at the conclusion of the year for many who claimed you to kid as the a centered.

- Basically, you deduct the costs around you probably pay them.

- For those who have put aside-associated take a trip that takes you more than 100 kilometers from your home, you will want to earliest done Setting 2106.

- From the 22Bet Gambling enterprise, the first deposit perks your that have a one hundred% Added bonus to 450 CAD.

- You haven’t provided more than half of one’s kid’s service.

When the none you nor other people has but really already been appointed because the executor otherwise officer, you could sign the brand new return to suit your mate and you may enter into “Filing because the enduring spouse” in your community in which you sign the fresh come back. You ought to document Mode 8857, Request for Simple Partner Rescue, in order to consult relief from shared duty. 971 teaches you these types of relief and you will just who could possibly get qualify for him or her. A married relationship away from two somebody is acknowledged for government taxation objectives if the relationship is recognized by the official otherwise territory from the united states where matrimony is entered for the, regardless of judge house.

For those who subtracted all of your benefits to the system, the whole amount you will get under the program is included inside the your income. Less than certain things, you can lose quantity you receive on the discretion out of coal and you will metal ore since the payments on the sales out of a money advantage, rather than since the royalty income. To have details about obtain otherwise losings on the product sales from coal and you may iron ore, see section dos from Pub. Of the count, you subtracted $two hundred on your own 2023 Agenda A great (Mode 1040).

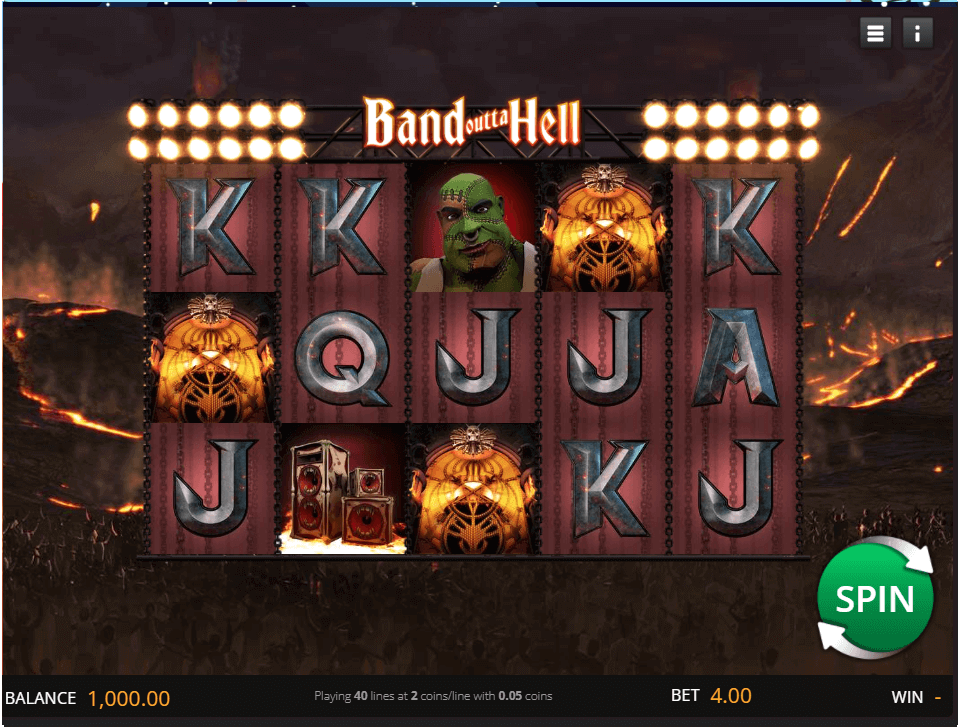

Bonus Words and ConditionsA better local casino extra goes beyond merely a great significant totally free spins or bonus loans. I very carefully become familiar with the brand new small print connected to for each and every extra, centering on wagering criteria, cashout constraints, and you will video game constraints. Online game Alternatives and you may App ProvidersA varied assortment of online game is essential to possess an excellent gaming experience. We measure the set of games offered by casinos on the internet, along with slots, dining table online game, real time specialist games, and a lot more.

Jackpot Area casino is actually all of our better step one dollars put gambling establishment to own lots of reasons, in the greater playing reception to your of use customer service. Yet not, it’s the newest multiple-region welcome incentive as well as the a lot of time payment processor chip roster that really ensure it is private. For those who experience our $1 put casino checklist, you’ll comprehend the word Confirmed on every added bonus discount. This means we’ve myself examined and you will tested the offer.

You would not be eligible to recover this type of can cost you if you do not made an effort to care for their case administratively, and checking out the is attractive system, and also you offered all of us everything needed to look after the case. Taxpayers have the to expect one to any suggestions they offer to the Internal revenue service are not expose until authorized by the taxpayer otherwise by law. Taxpayers feel the straight to predict suitable step would be removed up against staff, get back preparers, and others just who wrongfully explore otherwise divulge taxpayer come back guidance. Bona fide people from Puerto Rico are not any expanded necessary to features three or maybe more qualifying pupils becoming permitted claim the newest ACTC. For those who file Function 2555 (according to overseas made earnings), you could’t allege the brand new ACTC.

You could potentially claim the newest point 179 deduction merely in the year you put the auto in service. For this reason, a car is positioned operating if it is able and you can readily available for a specifically assigned include in a swap otherwise team. Even if you aren’t with the property, it is in-service when it is ready and you may designed for its specifically tasked fool around with.

Sorry, the comment form is closed at this time.